Finance lease: an alternative solution to borrowing

In this article, we’ll run you through everything you need to know about finance leasing for your small business.

0

min read

In this article, we’ll run you through everything you need to know about finance leasing for your small business.

0

min read

Leasing – a term we’ve probably all come across. Whether you’ve rented a home, a washing machine, or leased a car, the idea of paying for something you’re borrowing is pretty familiar to all of us.

But how can leasing work for your business? If you don’t have the funds to buy certain equipment, and you want an alternative way to borrow money, then finance leasing could be the solution for you. Without putting a strain on your own working capital and buying an asset outright, you can ‘borrow’ it instead and spread the payments out across time. There can even be some handy tax benefits, too.

Read on to find out all the ins and outs, with our guide to finance leasing.

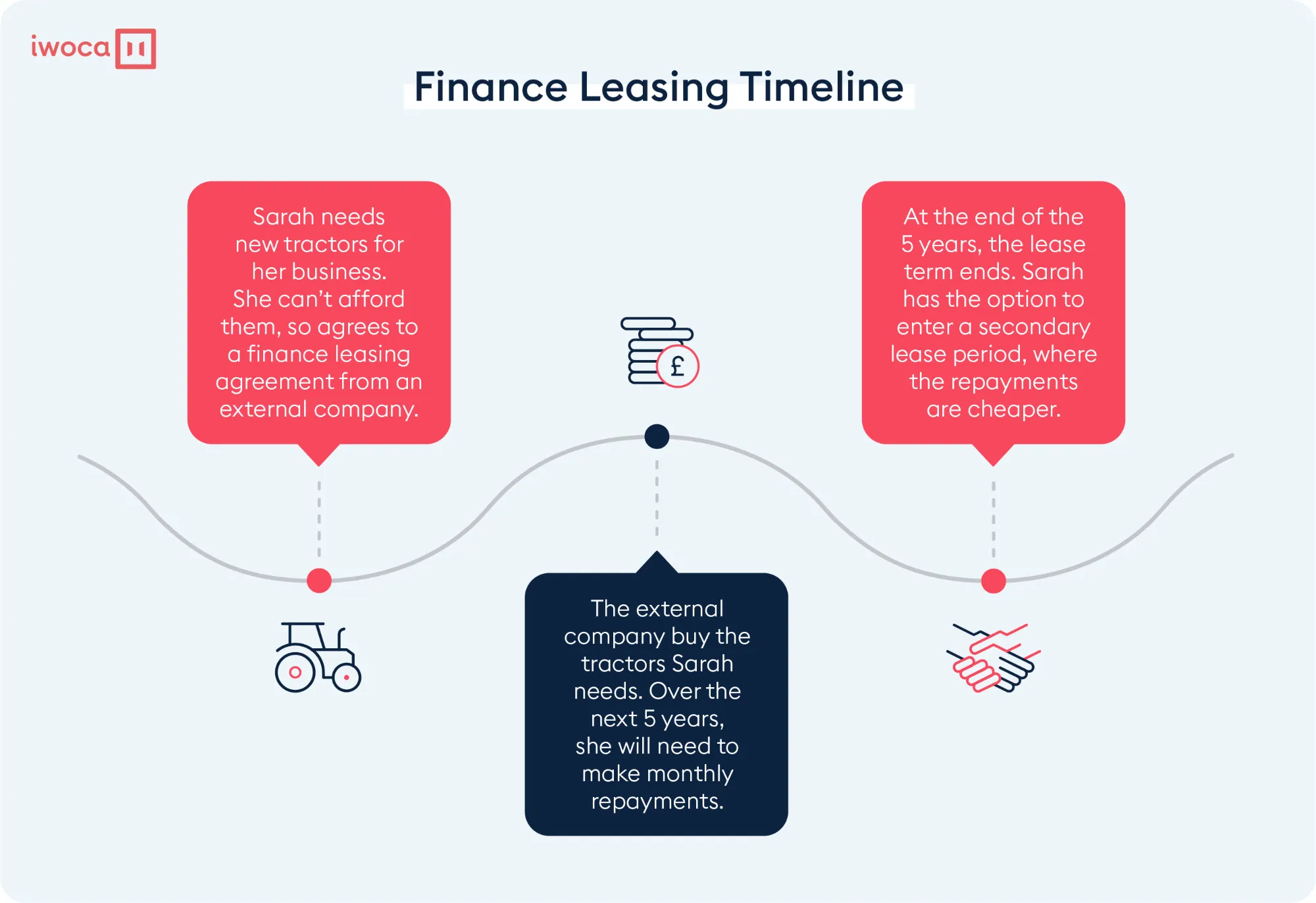

A finance lease (otherwise known as a capital lease) is a way for businesses to get financing, for things like equipment or vehicles, when they don’t have the cash upfront.

In a finance lease contract, there will always be two parties: the lessor and the lessee. We’ll be using these terms a lot, so just remember:

{{flexi-loan="/components"}}

The lessor buys the asset in question specifically for business equipment leasing, and rents it to the lessee for an agreed period of time. So in simplest terms, it’s a form of renting – the lessor buys the asset so technically owns it, but the lessee is able to use the asset by making rental payments.

The benefit of this is that the lessee is in a very similar position to if they had bought the asset themselves – they get exclusive use, as well as all the associated risks and rewards associated with owning that asset. Although the key difference is of course that they need to make regular payments, which covers the cost of the asset as well as added interest.

When entering a finance lease agreement, the lessee is committed to paying all the rentals within the specified period of time (often referred to as the primary period), with no option to cancel the lease.

When a business needs to purchase an asset but they don’t have the funds, then can use finance or capital leasing. This means the lessor will purchase the asset, and rent it to the lessee – allowing the lessee to have full use of the asset during the lease.

What makes something specifically a finance lease, is when the arrangement meets the following criteria:

If you’re successful in securing a finance lease, you will enter into a primary rental period. That is the agreed lease term, where your lease payments cover the full cost of the asset (as well as any interest the lessor applies). The primary rental period is typically as long as the useful lifespan of the asset, i.e. before it needs repairing or replacing.

Once you come to the end of the lease term, you’ll then have a choice to make. The options you’re presented with may vary, as every agreement is different. However, you would likely be looking at least one of these options:

For businesses who need to make a purchase, but lack the cash, there a plenty of financing options available. Financing generally means being provided funds – and this can come from traditional sources such as a bank, or somewhere more alternative like a crowdfunding appeal.

With these different types of financing, they all give you the money you need, as well as the opportunity to achieve your next business goal. However, leasing plays by its own set of rules – especially when it comes to ownership. If you acquire financing, then it normally means that a person, company or bank has invested in you and your business. This gives you the money you need to buy the asset, allowing you to have ownership of the asset as soon as you buy it. But you’d still have to be able to provide a return on the original investment.

With leasing, the asset isn’t actually yours during the lease term. You may work with the asset as if it were yours, but you’re not the owner.

This type of leasing is often used for equipment financing, helping businesses buy assets which come with a big price tag – such as machinery or vehicles – which would otherwise be unaffordable.

A lot of physical assets with high value can be acquired through finance leasing, including:

Finance leases are a hot topic for accountants across the UK – and for good reason, because when it comes to accounting for them, there’s quite a lot to consider.

Leases can be quite subjective, creating an opportunity to manipulate how they’re shown, to achieve a desired outcome. So much so, in fact, there’s even a name for it in the business – ‘off balance sheet finance’.

And, with the opportunity to take advantage of capital allowances, by deducting a percentage of the costs associated with a piece of equipment, it pays to make sure that you’re getting the right advice.

So make sure you speak to an accountant before you embark on any lease agreements.

Whilst you won’t actually own the asset you need, there are many benefits that come with finance leasing which makes it an appealing option.

Spread the cost

It saves you from having to spend a lot of money upfront. Finance leases are usually used for big ticket items, so many businesses don’t tend to have the money spare for the purchase. With a finance lease, you can make small, regular payments, rather than taking the expensive hit all in one go.

Simple budgeting

With set payments going out every month for a fixed duration of time, finance leasing takes away any unexpected expenses – helping you with your financial forecasting.

Flexibility at the end of the term

If you only need an asset for a certain period of time, then leasing might be a cost-effective way of doing this. But it’s also flexible – where you have the option to carry on using the asset, sell it or even give it back.

Tax savings

Finance lease payments are usually tax deductible as a business expense.

Finance leasing is a type of asset finance - ways to be able to pay for, or hire, the physical assets you need in your business.

There are also other types of asset finance, which may provide an alternative solution which works for you.

Hire purchase

Buy the asset you need, and pay for it in instalments. Like finance leasing, you’ll get to use the asset right away. However, with a hire purchase, once you come to the end of all the payments, you’ll fully own the asset.

Operating leases

You’ll often see the terms finance lease and operating lease together. And they are very similar so – however, when leasing an asset you won’t take on the responsibility of all the maintenance costs. That will sit with the lessor.

Asset refinancing

This is an interesting one – if you need a certain amount of cash, and fast, you can release some of the capital tied up in the equipment you’ve already invested in. A lender can buy your asset, and then lease it back to you over a period of time. You’ll still need to make regular payments to the lessor, but you’ll get that welcome injection of cash from selling it to them.

In this article, we’ll run you through everything you need to know about finance leasing for your small business.