What is Open Banking?

Open Banking ushers in a wave of opportunity that promises wholesale change in how we handle money.

0

min read

Open Banking ushers in a wave of opportunity that promises wholesale change in how we handle money.

0

min read

As technology has advanced, banks have gained ever more insight into where our money comes from and where it goes. For most of history, banks have kept this data locked away, thanks to a focus on both data and market security.

Then, in 2018, along came Open Banking. Banks, credit card companies and other financial firms must now hand control as to who can access this data to individual customers. This opens up all sorts of possibilities – some of which you might already be taking advantage of, such as budgeting apps linked directly to your bank account.

In this article, we'll cover the basics of Open Banking and look at the opportunities it could unlock for small businesses and start-ups.

Open Banking came into effect in January 2018. Banks, credit card operators and other financial companies in the UK must, by law, make the information they collect about you accessible to other service providers at your request. This access must be secure and meet the banks' own mantra of never asking you to share your password or login details.

This may not sound like a big deal, but creating a channel of secure, instant communication between your bank and any third party you grant access to changes a lot.

It frees up the marketplace to come up with better, more integrated ways to help you manage, move and make money more efficiently. It opens the door to innovative fintech companies and app developers to reinvent what banking means.

In short, it has the potential to shake up financial services and everyday transactions as never before.

Thanks to open banking, banks and financial institutions no longer have control over your information: you do. The banks must make it easy for you to share access to your data securely and safeguard you against cybertheft.

What this means in practice is that you can now grant access to an open banking compliant app or online service with a simple consent – similar to logging into a website using your Google or Facebook account. You can then see and choose exactly what information is shared.

Why would you want to share your financial information? Well, you might want to find out if you're good for a loan or a credit card. Or hook up with a budgeting app that will help you manage your cashflow and boost your savings. Or authorise a car park network to log charges using your car's registration plate.

The scope is infinite. Wherever and however we use money, open banking opens the door to making it an easier, smoother and safer.

{{flexi-loan="/components"}}

Open Banking is as safe as online banking and online shopping, and much safer than the old way of doing things – with confidential papers being mailed around the country and world. With Open Banking you never need to enter your login or password for anyone but your bank.

Open Banking was designed from the ground up to be at least as secure as online banking. The technology behind it uses APIs (application programming interfaces), which we already rely on hundreds of times a day when browsing the internet or using apps.

In the past, you may have been prompted to connect a service provider to your bank by entering your password so that an app could 'scrape' the data it needed. This is outlawed under Open Banking. Instead, banks and account providers must use strong customer authentication. This combats fraud and adds a critical layer of security.

Online service providers and apps wanting to take advantage of Open Banking must first be approved by the Financial Conduct Authority. You can check to see if a service provider is authorised by looking on the FCA Register or the Open Banking Directory.

We’ve always seen Open Banking as a way to make lending safer and simpler. In fact, we were the first UK lender to use it with our customers.Today, we’re using Open Banking to lend to customers in new ways.

Open Banking is all about creating more value for customers and consumers by offering better products, better experience and better protection. Its scope is huge. Leading the pack are challenger banks such as Monzo, Starling and Revolut who have blazed a trail for digital, mobile-only banking.

These banks offer a transparent alternative to high street branches. Customers can benefit from low cost accounts, automated budgeting systems and easier loan approval. In the B2B space, iwoca is leading the way. We integrate Open Banking to make better decisions about lending to our customers. By connecting things like bank accounts and accounting platforms, we can use data to understand more clearly how we can help individual businesses.

As for the big banks themselves, Open Banking has forced them to get with the times. Barclays was the first to give their customers the option to see all their bank accounts in one place, no matter the provider. HSBC has partnered with Bud, whose aim is to build a financial ecosystem to seamlessly connect people to financial services and products that improve their lives.

Here, we highlight some of the most popular Open Banking apps.

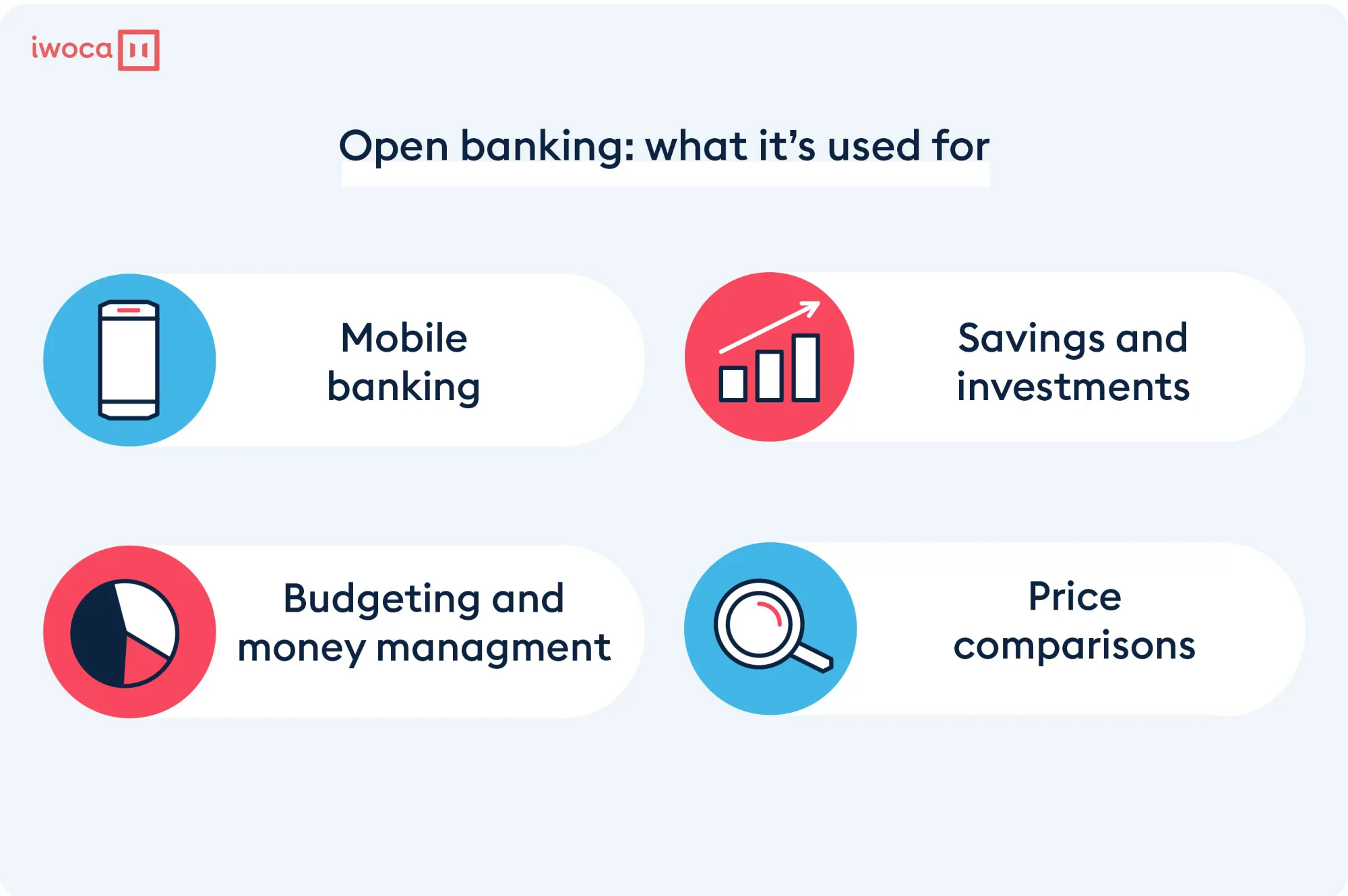

Mobile banking

Starling Bank, Monzo and Revolut are the big players here. Each has its merits and its legion of fans, so which one you go for is down to personal preference. No fees on overseas spending or local currency cash withdrawals, spend analysis and restaurant bill splitting are among the attractions.

All three of these new-age banks are forging strong relationships with their customers by breaking the mould. They listen closely to customer feedback, constantly seek out better ways of doing things and put the focus on the customer experience. They are everything your average high street bank never was.

Budgeting and money management

Yolt and Money Dashboard are among the best known of the money management apps.

The main selling points: see and manage all your bank and credit card accounts in one place, automatically sort your spending into categories, set budgets, monitor your outgoings, manage your bills.

At first glance, these features might not seem that exciting, but the whole point of apps like these is they're in business to make money management easy, fun and a lot more in tune with today's smartphone-driven world.

Saving and investing

Plum brings us the digital piggy bank. Casting a watchful eye over your day-to-day spending, Plum performs intelligent calculations and regularly sets aside small amounts of cash to put in your rainy day fund and help you reach your goals faster with minimum effort.

Chip does the same thing, using AI to tailor the amount and timing of this subtle saving habit. Sounds too good to be true, but then emptying the piggy bank was always a bit like finding a jar of free money. At the last count, Chip savers had stashed away over £85 million.

Price comparison

Imagine having the likes of Confused.com and Quidco beavering away in the background 24/7 to bring to you personalised recommendations and deals. That's what apps like Bud and Bean make possible.

Bud has teamed up with GoCompare to offer intelligent monitoring of your energy payments. Using this data, Bud can suggest a switch of supplier to save you money, which you can green-light without leaving the app. Bean does a similar thing through Comparethemarket, scanning all your bills and subscriptions and making sure you're not paying more than you need to. Clever stuff.

The benefits of open banking are huge, with both customers and innovators set to reap the rewards. Wherever our money goes, there's an app for that – if not now, then in the near future – thanks to Open Banking. Customers will be spoilt for choice. Finding deals will be easier than ever. Here are just a few of the main benefits we're already seeing:

Banks are no longer the boss

It's your money, your spending, your data. You decide who can access this highly personal information. If you want to pair up with service providers who can help you manage your finances better, your bank has no choice but to make it easy for you and must make sure all access is secure.

Tools to help us manage money better

You don't have the time or inclination to crawl price comparison sites day after day. Or be a secret savings agent, a personal tax assistant or an ad hoc financial adviser. But there are smart people out there building apps that do all these things and more. These look like becoming the financial tools we never knew we needed until someone invented them.

Fast-lane lending

Forget tedious form-filling. Ride the new wave and let the app talk to your bank directly. Keep track of your credit score. Get approved for a loan and have the funds in your account in an instant.

Automated accounting

Let's hear it for easier bookkeeping! So many of those tedious tasks we spend hours over or pay someone else to do can take care of themselves. Sending and receiving payments, invoice management, expense tracking, tax calculations… Apps are on hand to do the heavy lifting on the fly.

New ways to pay and accept payments

Not exactly new – PayPal and others have been pioneers of this – but Open Banking builds on the snappily named European Commission's Second Payment Services Directive (PSD2).

Under this legislation, banks must allow third party service providers to initiate payments on your behalf. That can only take us a step closer to buying almost anything with a click. Businesses can also look forward to lower payment processing fees.

You don't have to be in financial services to see the potential Open Banking can bring to your bottom line. Start-ups are certainly the biggest drivers of this financial revolution, but the scope for profitable partnerships is massive. And even if you don't harness the power of open banking directly, the ripple of change will flow through your transactions, whatever your business.

Open Banking ushers in a wave of opportunity that promises wholesale change in how we handle money.