Invoice finance explained

Invoice finance helps businesses to improve cash flow, pay both suppliers and employees, and invest in growing your business faster than if you had to wait on your customers paying their outstanding invoices.

0

min read

Invoice finance helps businesses to improve cash flow, pay both suppliers and employees, and invest in growing your business faster than if you had to wait on your customers paying their outstanding invoices.

0

min read

Invoice finance is a short term funding option that allows you to benefit from the value of outstanding invoices by receiving a percentage of their value in advance of their payment date. It’s like being paid early, or on time if the customer is late, at the cost of a percentage of that value. The amount you are charged for this service varies based on the profile of the customer you are invoicing and how much you intend to borrow, but could be as low as 10%.

Note, this type of finance is generally only suitable for businesses that invoice larger companies for goods or services. Also you may be responsible for repaying the full value of the invoice if your customer fails to pay.

Invoice financing operates as a means for businesses to unlock cash tied up in unpaid invoices.

This practice aids in maintaining a healthy cash flow, especially in instances where customers may take a long time to pay their invoices. It's a common practice among small to medium enterprises (SMEs) that operate with longer payment terms.

While the terms can vary from lender to lender, it can be useful to look at an example of invoice financing to see how it works.

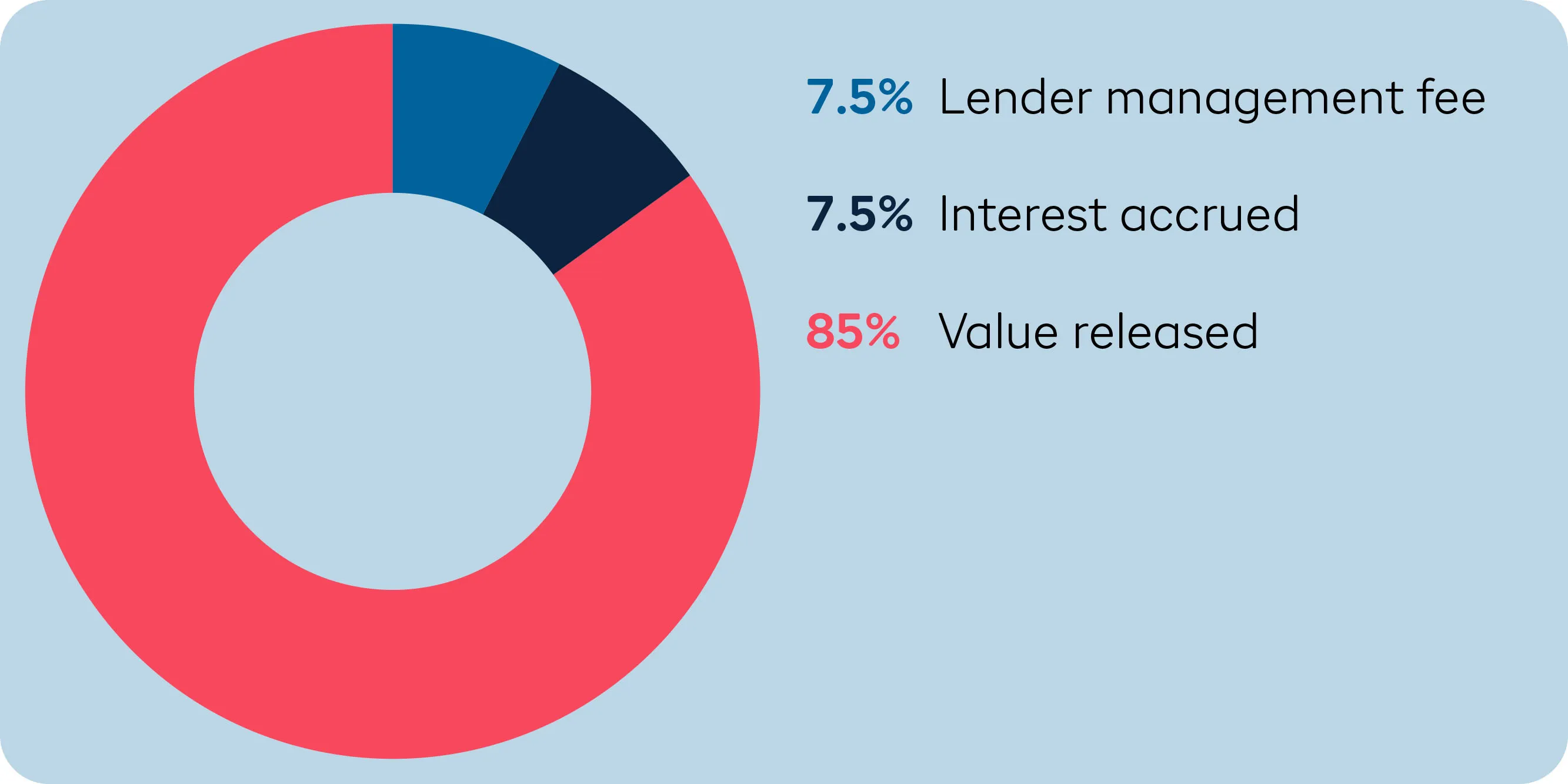

Costs for invoice financing come both from the fee from the lender as well as the interest on the sum borrowed.

In this example, the business is able to unlock 85% of the outstanding invoices value, paying 7.5% in fees and 7.5% in interest.

{{flexi-loan="/components"}}

Invoice financing is just one kind of small business finance option, and it comes with its own considerations. Check out the list below to understand whether it’s right for you.

There are a range of ways you can use your invoices to generate capital, with different costs, timelines and responsibilities involved. Below you’ll find the key types of invoice financing you need to know:

With recourse financing, your organisation agrees to take full liability for the invoice you've borrowed against. That means if it's unpaid by your customer then you'll be required to repay the money you have been advanced in full.

The remaining value of the invoice (usually between 10% and 30%) is held in reserve by the lender until your customer has made the full payment. The interest and management fee charged by your provider are deducted from this, and the rest is transferred to you. Those fees can vary hugely depending on which provider you choose.

With non-recourse financing, if your customer fails to pay their debt, your invoice finance provider will be liable for the losses incurred.

This is sometimes subject to limitations, so be sure to read the small print carefully. Because invoice financing on a non-recourse basis is riskier to the lender, it's often more expensive and much more difficult to get approved for than on a recourse basis.

Selective invoice finance, often known as spot factoring, is a flexible type of invoice financing used in the UK. Unlike whole ledger invoice finance, where you are obligated to factor all your invoices, selective invoice finance allows you to choose specific invoices to factor.

This means you can decide to finance only high-value invoices or those from customers with long payment terms to maintain cash flow. It's quite an beneficial option for you if you don’t want to commit to long-term contracts or if your business is seasonal. This method provides immediate funds and can be a cost-effective alternative, given that fees are only applied to the selected invoices.

Invoice financing actually refers to two related, but slightly different, financial services – invoice discounting and invoice factoring. Both allow you to use your invoices as collateral to secure a credit line, but their differences are important.

Invoice factoring, also known as debt factoring, is a contract involving an invoice finance provider managing your sales ledger and collecting money owed by your customers themselves.

This means your customer will be fully aware you’re using invoice finance. Using invoice factoring can free you from time-consuming invoice collection and allow you to concentrate on your business. Most invoice finance providers want you to have a sales volume of more than £250,000 per year before they’ll consider factoring your invoices.

Invoice discounting is different from factoring in that your customer’s payments are directed to a trust account in your name, held by your invoice finance provider. This means your provider won’t take responsibility for collecting payment for the invoice, so your customer won’t know that you’re using invoice finance.

It is usually only available to companies which turn over more than £1 million per year. Invoice discounting permits you to maintain close ties to your customers and continue to manage your sales ledger yourself. You might prefer this if you’re worried about how your finance provider might manage the collection of your invoices.

Typically, there are two main costs associated with invoice financing

Interest rates for this type of funding are similar to invoice factoring and invoice discounting, and are usually between 1.5 and 3% per year above the Bank of England base rate. Management fees are paid on the total value of the invoices you advance. This is generally around 0.2% - 0.5% with discounting, and 0.75% - 2.5% with factoring.

This means invoice factoring is much more expensive than discounting. This is because the factoring provider has taken over responsibility for chasing your invoices for repayment, and takes on the extra cost of this service. You should also be wary of any additional fees the invoice finance provider might charge (see their FAQs for details).

Besides interest and management fees, are there other costs to consider?

There are a range of invoice finance rates that you might be charged when using invoice financing. Here’s a run-down of the fees you should consider:

If you’re in need of short term financing for your business, iwoca can help you connect to capital fast. You can apply for a flexible business loan in minutes, with decisions based on your actual business performance. Once approved, the funds can be in your account in hours.

Invoice finance helps businesses to improve cash flow, pay both suppliers and employees, and invest in growing your business faster than if you had to wait on your customers paying their outstanding invoices.